Make business less taxing

Guild Freelancing is a payments service that eliminates tax status & IR35 uncertainty so that you can engage and manage freelance talent securely. Freelancers that we pay earn 25%* more on average than similar roles under PAYE or through umbrellas while your business improves its bottom line. All of this at £0 cost to your business.

How Guild Freelancing works:

We're not your everyday freelancer payments service.

Your freelancers earn more and you improve your bottom line

Our calculations show that freelancers earn 25% more on average when compared with umbrella employees or those on PAYE contracts. Your company also saves thousands on employment costs, at £0 cost to your business.

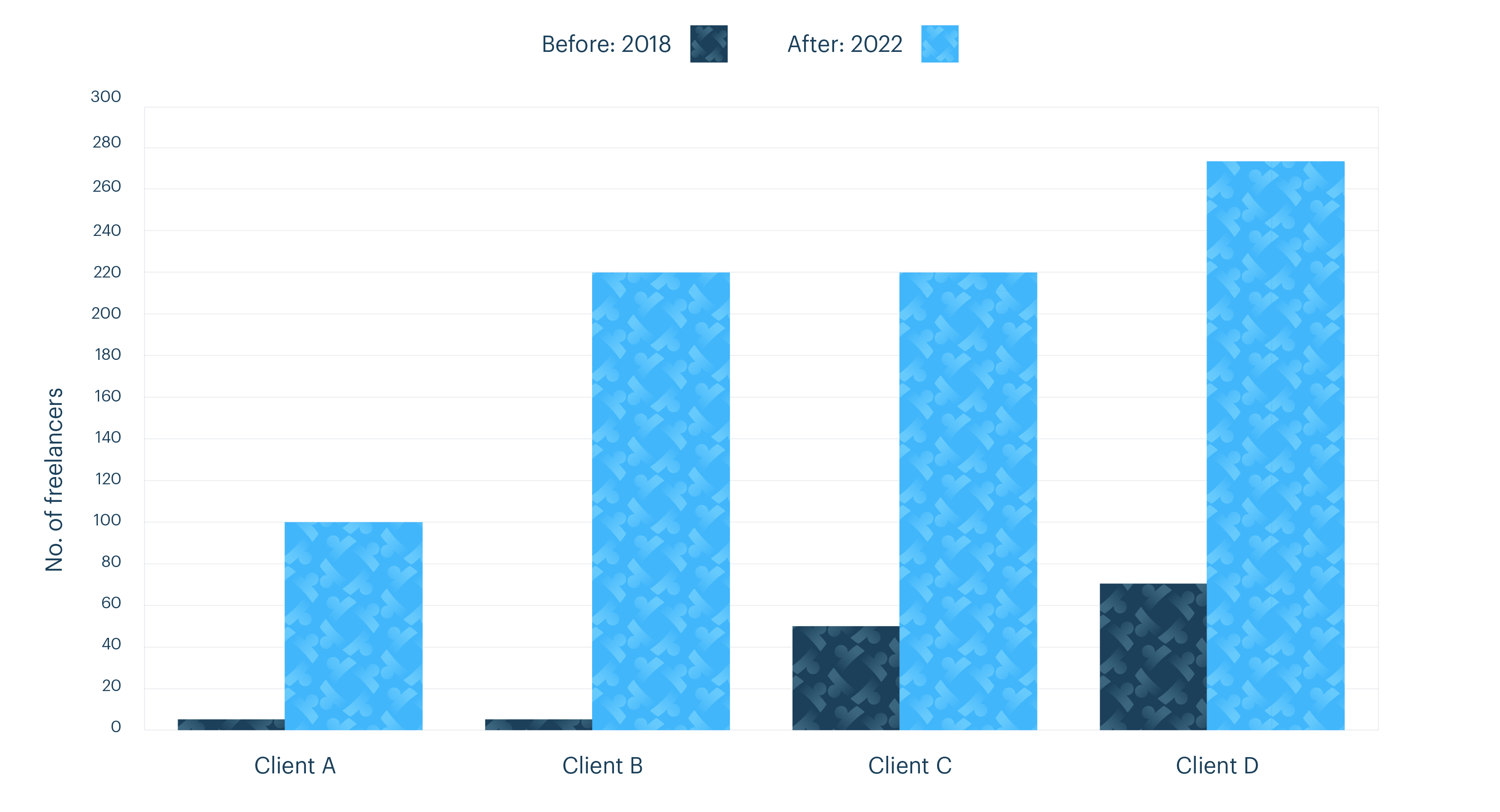

Attract and retain talent to gain an edge over competitors

Businesses contracting their workforce through Guild Freelancing tend to grow their team significantly due to the higher pay they can offer. You’re able to leap over competitors by attracting industry-leading talent as workers capable of self-employment earn more as Guild Freelancers.

You’re 100% protected against status risk and IR35 risk

Being an intermediary, Guild Freelancing inserts itself into the contractual chain during payment and assumes all tax status risk and payroll responsibility for your freelancers. All clients are indemnified, and our risk is insured.

We handle status compliance and payrolls so you don’t have to

After onboarding, your team no longer need to submit invoices (to you or us) as we operate a self-billing system with all freelancers. Should you want greater control, you can track and handle payments through our online portal.

The Guild Group has been trusted by over 1000+ businesses and counting

10,000+ freelancers paid weekly

No late payments

£420+ million yearly turnover

20+ years in business

Our simple onboarding process

Schedule a Call

You’ll get to speak to one of our legal experts who will offer you a tailored solution for your business. You can then provide us with details of the people you want to onboard as freelancers. It’s 100% free and there’s 0% pressure.

Status Assessment

Our friendly team will ask your freelancers a few questions about their craft so we can ensure they’re able to receive the Guild Freelancing stamp of approval. We’re not an umbrella, so all people contracted through us are treated as genuine freelancers.

Ready for Payment

We now get to update you with the good news: your team are onboarded and ready for payment. Time to start raking in some major savings.

Invoicing & Payment

Once you let us know who we need to pay and when they need to be paid, we’ll handle the rest. Since we put ourselves in the payment chain, Guild Freelancing takes on all status risk and deals with all the taxing legal stuff. You get to perfect your dream team without a care in the world.

Like what you're hearing?

Client growth examples under the Guild Group

Earning potential comparison with Guild Freelancing vs Umbrella

|

Weekly Pay

|

Umbrella Take Home Pay

|

Freelance Take Home Pay

|

Extra Earning Per Week with

|

Extra Earning Per Year with

|

|---|---|---|---|---|

|

£700

|

£502.21

|

£603.74

|

£101.53

|

£5,279.56

|

|

£1,000

|

£683.73

|

£821.42

|

£137.69

|

£7,159.88

|

|

£1,200

|

£798.51

|

£966.53

|

£168.02

|

£8,737.04

|

|

£1,400

|

£902.51

|

£1,090.47

|

£187.96

|

£9,773.92

|

|

Two assumptions apply to the weekly pay of an umbrella or PAYE contract compared with Guild Freelancing:

|

||||

All of this at £0 Cost to your business

The Guild Freelancing solution is totally free for your business. Freelancers working with you will experience a margin of £21 taken from their gross weekly pay. Our commitment to them in exchange for this small cost is the priceless freedom to freelance with total security, and the potential for significantly higher earnings. Guild Freelancers can earn 25% extra than peers in similar roles under umbrellas or in PAYE.

Guild Freelancing is for businesses looking to …

- Improve their bottom line and their workforce’s pay at £0 cost

- Maximise their ability to attract and retain industry-leading talent

- Contract directly with freelancers but wish to remove status risk

- Find alternatives to costly employment or long project cycles

- Want to move away from umbrellas which damage their ability to attract talent

Could your business survive if your freelancers aren’t accepted as self-employed by HMRC?

Your company could owe *millions* in tax liabilities if HMRC intervenes and finds that your freelancers aren’t accepted as self-employed by HMRC. Try our calculator to see how much you could lose without the Guild Freelancing guarantee.

- Calculation does not include penalties or interest

- Calculation averages National Insurance Contribution at 21% over 3 years

Let's get you started.

Email us

Email us!

Call us

Want to speak with our sales team one-on-one to find out how Guild Freelancing can offer a bespoke solution for your business?

Book a call through our Calendly link.

Don't believe us?

Here's what our clients say about the Guild group:

J&L have been using the Guild [Group] for 12 years now, in that time they have provided us with 5 star payroll services and have ensured we are always up to date with the latest legislations. Our operatives get paid on time, without any issues. The customer service levels are outstanding, you can tell they really care about their clients and subcontractors. We would have no issue in recommending The Guild.

J&L Carpentry Ltd

At every level of their business the people I have dealt with have been professional and very efficient offering us a great service.

I cannot fault them and would totally recommend their services to others.

Quattro Plant Ltd

Lorclon have used The Guild Group for the last fifteen years . Never once in that time has a single payment to a single individual been missed.

Trust is the most important thing in relation to payments and we trust The Guild completely.

Lorclon Ltd

They have taken all the stress away from us dealing with Sub contractor payments. The staff are so helpful

whenever we call or Email

I would recommend their services to any company who deal with sub-contractor

payments.

It is a pleasure working with them.

Moyne London

We have found [Linda] to be a great person to work with.

She has a wide range of expertise which she has always been proactive in sharing with us when complex new regulations have come into force from HMRC.

Raytell Electrical Co. Ltd

Book a quick call with our experts!

Our experts are happy to offer tailored advice for your business, unriddle any confusion about tax law and explain the amazing savings you could make.